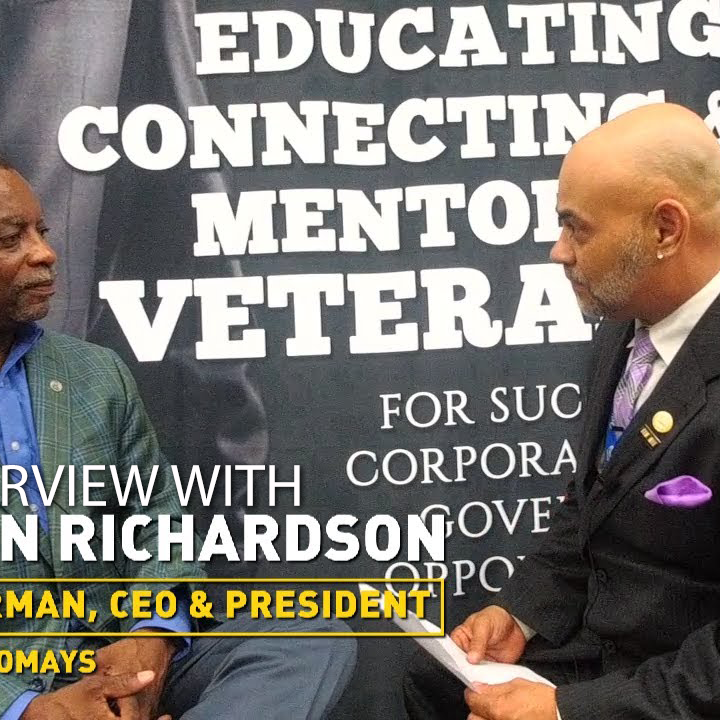

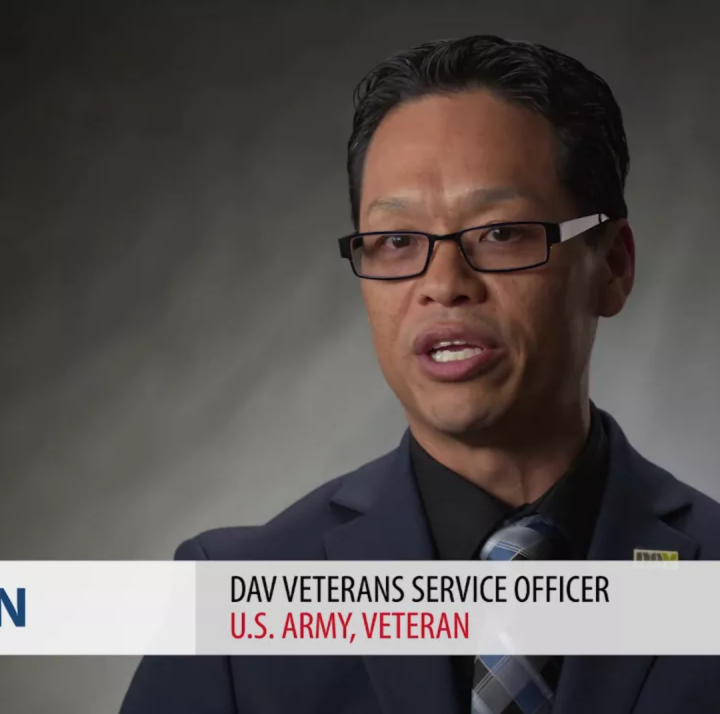

Business capital funding is essential for new veteran owned businesses (VOBs). There are a variety of funding options available that include federal, state and private organizational financial support. Veteran Owned Business Roundtable (VOBRT) is firmly committed to identifying funding resources and capital for VOBs.

SBA funding for veterans

The SBA has several financial programs specifically targeted to assist veteran owned businesses.

· SBA Veterans Advantage

The Veterans Advantage Guaranteed Loans Program benefits the veteran business owner by offering a reduction in certain loan program fees. The SBA Veterans Advantage program provides a guarantee for loans approved to veteran owned or military spouse owned businesses during fiscal year 2017. If the loan is over $150,000 the business will receive the benefit of its regular guaranty fee reduced by 50 percent. In addition, the program also reduces barriers that veteran owned business may encounter when they attempt to access capital.

Veteran owned business can apply for capital assistance via the SBIC program. SBICs are entirely privately owned and managed investment funds. They are regulated by the SBA. A SBIC firm will make equity and debt investments to veteran owned businesses that qualify. These firms are regulated and licensed by the SBA.

Veterans and military spouses who are eligible will have their upfront borrowers reduced to zero on SBA Express loans up to $350,000.

The SBA does not have legal authority to grant small businesses funding grants. Yet some grants are available through states, which typically require the business to match funds that are granted. In addition, there are business organizations that provide funding for veteran owned business. They include:

- StreetShares provides loans up to $100,000 for veteran owned businesses that are one year or older. They also assist VOBs owned by a family member. StreetShares Foundation also offers monthly cash awards to veteran owned businesses.

- Hivers and Strivers is an investment fund that targets financial assistance for companies run by U.S. Military Academies graduates. They provide investments from a quarter million to $1 million.

One alternative funding source to seriously consider for your veterans owned business is the Rollover for Business Startups known as Business Owner’s Retirement Savings Account or BORSA. BORSA allows you to invest your retirement funds in a business without paying income taxes or early withdrawal penalties.

For more information on funding assistance or resources contact us today.